Agrochemicals Market Sales to Top USD 382.1 Bn by 2034 | By Top Key Players - BASF SE, Bayer AG

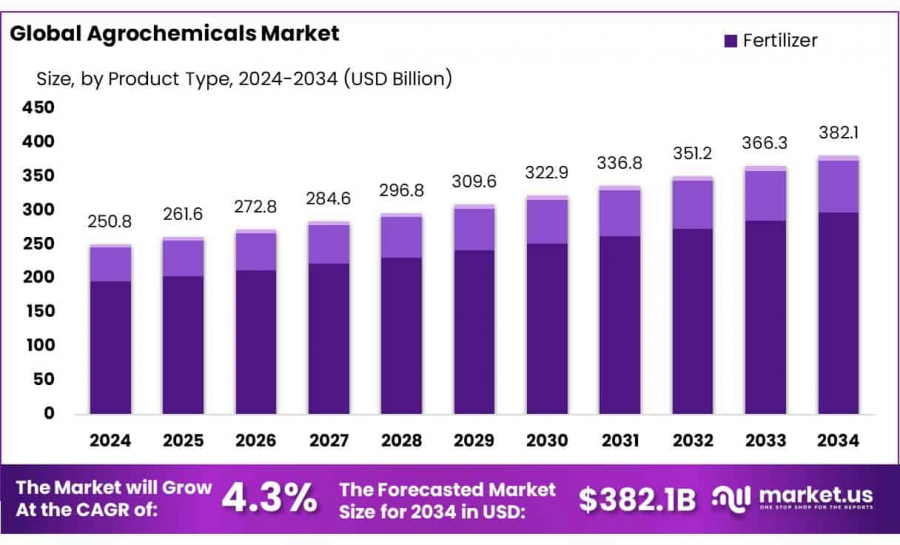

Agrochemicals Market size is expected to be worth around USD 382.1 Bn by 2034, from USD 250.8 Bn in 2024, at a CAGR of 4.3% from 2025 to 2034

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global agrochemicals market is a critical component of the agricultural sector, providing essential products that support crop growth and protection. Agrochemicals, which include fertilizers, pesticides, herbicides, and insecticides, play a pivotal role in enhancing crop yield and quality, addressing the pressing need for food production amidst growing global populations and shrinking arable land.

Driving Factors of agrochemicals to increase in population and subsequent rise in food demand necessitates the use of agrochemicals to prevent crop losses and increase food production. Secondly, the reduction in arable land per capita is pushing farmers to adopt intensive farming practices, which often require effective pest and nutrient management solutions provided by agrochemicals. Additionally, economic growth in emerging markets has led to increased purchasing power and demand for diverse agricultural produce, further propelling the use of agrochemicals.

The demand for agrochemicals is evolving, with significant growth in bio-based and organic product segments. This shift is largely due to heightened awareness of environmental issues and health concerns related to synthetic agrochemicals. Farmers and agricultural enterprises are increasingly adopting integrated pest management practices that favor biopesticides and other sustainable agrochemical solutions. This trend is supported by governmental regulations that promote environmentally friendly farming practices and restrict the use of certain toxic chemical formulations.

Technological advancements are reshaping the agrochemicals industry. Innovations in chemical research have led to the development of more efficient and less environmentally damaging agrochemicals. For instance, nano-formulations of pesticides and fertilizers enhance the delivery mechanisms and efficacy of active ingredients, reducing the quantity of chemicals needed and minimizing their environmental footprint. Additionally, advancements in biotechnology are facilitating the creation of genetically modified crops that are more resistant to pests and diseases, which in turn influences the types of agrochemicals required for effective crop management.

The development of smart agrochemicals, which are capable of responding to environmental conditions to release active substances, represents a future growth area. Such innovations could greatly enhance the precision and sustainability of agrochemical applications. Additionally, regulatory support for environmentally sustainable and food safety standards across the globe will likely spur innovation and adoption of advanced agrochemical solutions.

For a deeper understanding, click on the sample report link: https://market.us/report/agrochemicals-market/free-sample/

Key Takeaways

◘ The Global Agrochemicals Market is projected to reach USD 382.1 billion by 2034, growing from USD 250.8 billion in 2024, at a CAGR of 4.3% during the forecast period from 2023 to 2033.

◘ Fertilizers dominated the market in 2024, capturing over 78.30% share, due to their crucial role in enhancing soil fertility and crop productivity. The increasing adoption of precision farming and demand for higher crop yields are key growth drivers.

◘ Solid formulations accounted for more than 67.90% of the market share in 2024, owing to their ease of handling, longer shelf life, and efficient application.

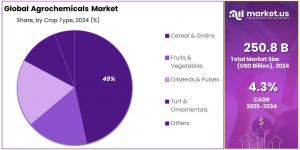

◘ Cereals & grains held the largest market share of 49.20% in 2024, with crops such as wheat, rice, corn, and barley driving significant demand for agrochemicals.

◘ Asia Pacific (APAC) led the market with a 52.40% share in 2024, valued at approximately USD 131.4 billion, driven by large-scale agricultural activities in China, India, Japan, and Southeast Asia.

Agrochemicals Top Trends

1. Shift to Generic Agrochemicals: Farmers are increasingly opting for generic crop protection products over branded ones to reduce costs. This trend is influenced by the expiration of patents on key active ingredients, leading to a broader availability of affordable generic options.

2. Integration of Artificial Intelligence (AI): Agrochemical companies are leveraging AI to expedite the discovery and development of new pesticides and herbicides. AI aids in analyzing complex data, predicting outcomes, and optimizing formulations, thereby reducing time-to-market and R&D costs.

3. Focus on Environmental Sustainability: There is a growing emphasis on developing eco-friendly agrochemicals with lower environmental impact. Companies are investing in products that are less toxic to non-target species and degrade more readily in the environment, aligning with stricter regulatory standards.

4. Adoption of Precision Agriculture: The use of technologies such as drones, GPS, and IoT devices enables precise application of agrochemicals, minimizing waste and environmental impact. This approach enhances efficiency and supports sustainable farming practices.

5. Development of Bio-Based Agrochemicals: There is an increasing trend toward bio-based agrochemicals derived from natural sources. These products offer a sustainable alternative to synthetic chemicals, catering to the rising demand for organic farming solutions.

Key Market Segments

By Product Type Analysis

In 2024, fertilizers dominated the global agrochemicals market, holding a 78.30% share. Fertilizers play a crucial role in modern agriculture by supplying essential nutrients such as nitrogen, phosphorus, and potassium, which are necessary for healthy crop growth and improved agricultural productivity. The growing need for higher crop yields, particularly in regions facing food security challenges, has fueled demand for fertilizers. These products are widely used across cereals, fruits, vegetables, and oilseeds, making them integral to global agricultural practices. Additionally, the increasing adoption of precision farming techniques has accelerated the demand for specialized and highly effective fertilizers.

Potassic fertilizers represent another key segment, witnessing steady growth due to their role in improving root development, disease resistance, and crop quality. Potassium is essential for numerous plant physiological processes, and its targeted use is gaining prominence in potassium-deficient soils. As the agricultural industry moves towards more sustainable practices, the demand for potassic fertilizers is expected to rise, particularly in regions where soil health is a growing concern.

By Formulation

In 2024, solid formulations captured a 67.90% market share, making them the dominant choice in the agrochemicals market. Solid formulations, including granules, powders, and pellets, are widely preferred due to their ease of handling, precise application, and long shelf life. These formulations are commonly used in fertilizers, pesticides, and herbicides, offering controlled release and enhanced effectiveness over time. Their stability and efficiency make them well-suited for large-scale agricultural operations, where consistent and uniform application is crucial. The rising demand for bulk treatments in cereals, vegetables, and fruits has further driven the adoption of solid agrochemicals.

Liquid formulations, though holding a smaller market share, have been steadily gaining traction, particularly in regions with advanced farming techniques. Liquid agrochemicals are frequently used in foliar spraying, where rapid absorption and quick action are essential. Their ease of mixing and application makes them highly suitable for specialty crops requiring precise treatments. While liquid formulations continue to expand, their growth rate remains lower than that of solid formulations due to differences in storage, transportation, and application requirements.

By Crop Type

In 2024, cereals & grains were the leading crop segment, holding a 49.20% market share. Key crops such as wheat, rice, corn, and barley are fundamental to global food security, driving significant agrochemical use. The high demand for cereals and grains, coupled with the necessity for efficient pest control and nutrient management, has fueled extensive agrochemical application in this sector. Farmers rely on fertilizers, pesticides, and herbicides to maximize yields and maintain quality, particularly in regions with large-scale farming operations.

Fruits & vegetables were the second-largest crop type segment in 2024. Although they hold a smaller share than cereals and grains, demand for high-quality, fresh produce continues to rise due to population growth and consumer preference for healthy foods. Agrochemicals used in fruits and vegetables focus primarily on pest control, disease prevention, and crop enhancement to improve both yield and quality.

Key Market Segments List

Product Type

- Fertilizer

—— Nitrogenous

————— Urea

————— Ammonium Nitrate

————— Ammonium Sulfate

————— Ammonia

————— Calcium Ammonium Nitrate

————— Others

—— Phosphatic

————— Monoammonium Phosphate (MAP)

————— Diammonium Phosphate (DAP)

————— Triple Superphosphate (TSP)

————— Others

—— Potassic

————— Potassium Chloride

————— Potassium Sulfate

————— Others

- Pesticide

—— Insecticide

—— Fungicide

—— Herbicide

—— Bio-pesticide

—— Others

- Plant Growth Regulators

Formulation

- Solid

- Liquid

Crop Type

- Fruits & Vegetables

- Cereal & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

Application Method

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

Regulations On the Agrochemicals Market

Regulatory Frameworks: Governments establish comprehensive guidelines overseeing the lifecycle of agrochemicals, from manufacturing to usage. These frameworks involve multiple stakeholders, including scientific experts and industry representatives, to assess potential health and environmental impacts, ensuring that only safe and effective products are available in the market.

Registration and Approval: Before agrochemicals can be marketed, they must undergo a rigorous registration process. This involves evaluating scientific data on toxicity, environmental persistence, and efficacy. Regulatory bodies review this information to determine whether a product meets safety standards, granting approval only when it poses no unreasonable risks.

Labeling and Usage Instructions: Approved agrochemicals are required to have clear labeling that provides detailed usage instructions, safety precautions, and first-aid measures. Proper labeling ensures that users are informed about correct application methods, dosages, and necessary protective equipment, thereby minimizing the risk of misuse and associated hazards.

Monitoring and Compliance: Regulatory agencies conduct ongoing monitoring to ensure compliance with established standards. This includes inspecting manufacturing facilities, evaluating product formulations, and assessing field applications. Enforcement actions, such as fines or product recalls, may be implemented if violations are identified, maintaining the integrity of the regulatory system.

International Harmonization: Efforts are underway to harmonize agrochemical regulations globally, facilitating trade and ensuring consistent safety standards. International organizations work towards creating unified guidelines, although achieving complete harmonization remains complex due to varying regional priorities and risk perceptions.

To Get Moment Access, Buy Report Here: Enjoy Discounts of Up to 30%! https://market.us/purchase-report/?report_id=103949

Regional Analysis

The Asia Pacific (APAC) region dominates the global agrochemicals market, holding a 52.40% market share in 2024, valued at approximately USD 131.4 billion. This leadership position is driven by extensive agricultural activities across China, India, Japan, and Southeast Asian nations. The region's large population and growing concerns over food security have fueled significant demand for agrochemicals, particularly in the cultivation of staple crops like rice, wheat, and corn. Increasing government initiatives to enhance agricultural productivity and the rising adoption of high-yield farming techniques further support market expansion in APAC.

North America holds the second-largest market share, with the U.S. and Canada being key contributors. The region benefits from advanced farming techniques, high mechanization levels, and strong demand for crop protection solutions in both conventional and organic farming sectors. The increasing adoption of precision agriculture, coupled with government incentives promoting sustainable farming practices, has accelerated agrochemical usage in this region.

Europe also plays a significant role in the global agrochemicals market, accounting for 16.30% of the total share. The market in this region is shaped by stringent regulatory frameworks governing agrochemical usage and a growing shift toward organic and eco-friendly alternatives. Countries such as Germany, France, and Italy lead in agrochemical consumption, balancing the need for crop productivity with sustainability efforts. The emphasis on integrated pest management (IPM) strategies and reduced chemical usage is expected to influence future market growth across Europe.

Key Players Analysis

- BASF SE

- Bayer AG

- Syngenta

- UPL Limited

- Nufarm

- ADAMA Ltd

- Corteva, Inc

- Yara International ASA

- ADM

- Nutrien

- K+S AG

- Sumitomo Chemical Co., Ltd.

- Compass Minerals International, Inc

- ICL Group Ltd.

- Isagro

- FMC Corporation

- OCP Group

- Other Key Players

Conclusion

The Agrochemicals Market is poised for steady growth, driven by the increasing global population and the consequent demand for higher agricultural productivity. Advancements in precision farming and the development of bio-based agrochemicals are fostering sustainable agricultural practices. However, the industry faces challenges such as stringent environmental regulations and the need for continuous innovation to address pest resistance. Companies investing in research and development to create eco-friendly and efficient solutions are likely to maintain a competitive edge in this evolving landscape.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Agriculture, Farming & Forestry Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release